#CREDIT SCORE RANGES STATUS FOR FREE#

You can check your credit reports from each of the three credit bureaus once a year for free through (Note that through April 2021, you can check it for free weekly).

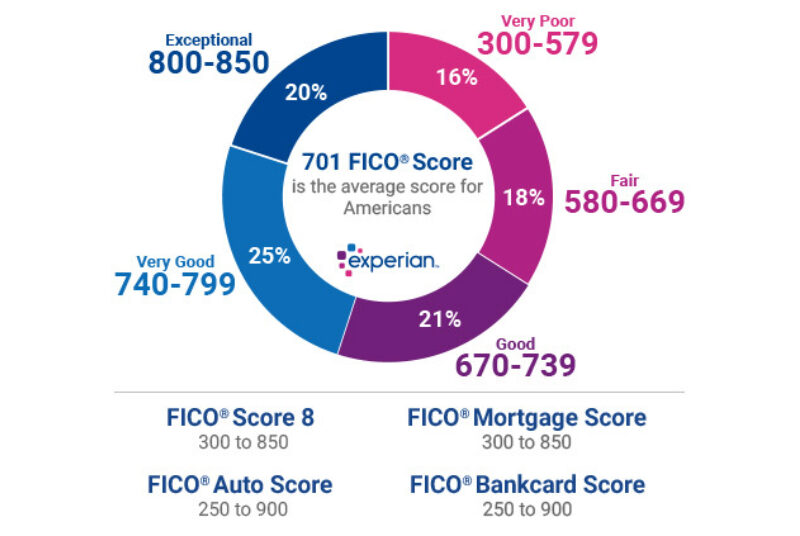

If possible, aim for 30% or less overall and on individual credit cards. For example, if you have a $10,000 limit and debt of $5,000, you’re utilizing 50% of your available credit. Credit utilization is measured by how much of your credit limit you use. Late and missed payments are the single biggest factor affecting your score. Pay your bills on time every single month.If you have an average credit score or worse, it’s worth taking steps to improve your score over time. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders. VantageScores use a 300 to 850 credit score range. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too. Launched in 2003, VantageScore is a joint venture between the three major credit reporting agencies-Equifax, TransUnion and Experian. Related: FICO Score Facts You Probably Didn’t Know VantageScore Credit Score Ranges The higher your score, the lower the risk you represent to anyone who lends you money. They help lenders predict the risk of a borrower defaulting on a loan. Regardless of the range, FICO Scores serve the same purpose. Auto FICO scores, for example, range from 250 to 900. There are also industry-specific FICO scoring models that use a different scale. A good credit score is pretty similar between FICO and VantageScore scoring models with a few key differences: FICO Score RangesįICO is the oldest and most widely used credit score brand and uses a scoring range of 300 to 850.

Note that checking your credit score yourself will not affect the credit score at all, even if you do it very often.In the United States, there are two popular credit score brands that compete in the lending marketplace: FICO and VantageScore. However, if you have more frequent credit activity you can check it more often. The minimum is that you check your credit score at least once a year, though checking it every quarter is recommended. While credit bureaus like CRIF Highmark mandatorily offer only one free credit report each year, a credit score can be checked multiple times per year. If you want to check it more frequently, you can do so with a payment of ₹399 (including GST) from CRIF Highmark.Ī person’s credit score is calculated using their credit report. However, as mentioned above, you can check your credit report for free only once a year. This can be done as often as you want to. Once you have completed this process, you can check your credit score, which is calculated from the credit report. Step 6: If you answer the security credit question correctly, your CRIF credit report will be available to you for download.Step 5: Once you review and submit this information, you will be asked one security credit question, which will be based upon your records.

#CREDIT SCORE RANGES STATUS FULL#

These include: your full name, date of birth, mobile number, address, and Aadhaar or PAN number.

0 kommentar(er)

0 kommentar(er)